Dear Friend:

Thank you for contacting me regarding the future of the Social Security system. I welcome your thoughts and comments.

The Social Security program is financed by the Federal Insurance Contributions Act (FICA) tax, a payroll tax that is collected from today's workers and used to pay benefits to those seniors currently drawing from Social Security. The FICA tax is levied on both employees and employers on wages up to a limit of $106,800. Traditionally, the Social Security tax is 12.4% of wages and is split evenly, with the employee’s share of the tax at 6.2% of gross compensation and the employer subject to an additional 6.2% FICA tax. However, through the extension of the broader tax relief of 2001 and 2003, the employee share of the FICA tax is reduced to 4.2% of gross compensation for 2011. To make up for the lower FICA taxes, the Treasury Department is authorized to transfer funds equal to the amount that would have been contributed into Social Security Trust Funds in normal years.

The Social Security Board of Trustees reports to Congress on the status of the Social Security Trust Funds. The trustees project the balance of the Social Security Trust Funds to peak in 2024 but to be fully depleted in 2037. Thus, while the Social Security program is sound for today's seniors and for those nearing retirement, it needs to be improved for our children and grandchildren.

The impending financial problems of the Social Security program are why Congress must work together now to strengthen Social Security for future generations. The longer we wait, the more difficult and costly it will be to fix the problem. Every year that passes adds $600 billion in unfunded liabilities that the next generation will have to pay.

Congress is considering a wide range of reforms, including proposals to raise the retirement age or increase the cap on the FICA tax. I will continue to evaluate any plan to reform Social Security by how well it protects current recipients while ensuring the soundness of the system for future generations.

I appreciate hearing from you, and I hope that you will not hesitate to contact me on any issue that is important to you.

Sincerely,

Kay Bailey Hutchison

United States Senator

Friday, May 27, 2011

Thursday, May 26, 2011

Third Rail Stress Test.

Dear Senator Hutchison,

I know you are aware of the looming problems with our Social Security system. In fact, this is from your own website:

Americans have paid their taxes into the Social Security system in good faith, and they deserve a return on their investment. However, by the year 2018, as the “Baby Boom” generation enters retirement, the program is projected to pay out more in annual retirement than it takes in from Social Security taxes. This would leave future generations with no benefits from a fund into which they poured their hard-earned wages. There are a wide variety of proposed reforms before Congress, including the creation of personal retirement accounts that give citizens control over their own savings.

I notice you don’t mention your own position on Social Security reform. What is your position? Do you favor the status quo, which is projected to run deficits beginning just seven years from now? Or do you favor reforming the system to make it solvent? As you noted, proposed reforms include the creation of personal retirement accounts. Proposed reforms also include raising Social Security taxes, cutting Social Security benefits, or some combination of the two. If you support Social Security reform, please state what reform(s) you support and explain the effect on the sustainability of our Social Security system.

America thanks you in advance for your candid response clearly outlining your position on Social Security. I will post your response on my blog.

Regards,

luridtransom

I know you are aware of the looming problems with our Social Security system. In fact, this is from your own website:

Americans have paid their taxes into the Social Security system in good faith, and they deserve a return on their investment. However, by the year 2018, as the “Baby Boom” generation enters retirement, the program is projected to pay out more in annual retirement than it takes in from Social Security taxes. This would leave future generations with no benefits from a fund into which they poured their hard-earned wages. There are a wide variety of proposed reforms before Congress, including the creation of personal retirement accounts that give citizens control over their own savings.

I notice you don’t mention your own position on Social Security reform. What is your position? Do you favor the status quo, which is projected to run deficits beginning just seven years from now? Or do you favor reforming the system to make it solvent? As you noted, proposed reforms include the creation of personal retirement accounts. Proposed reforms also include raising Social Security taxes, cutting Social Security benefits, or some combination of the two. If you support Social Security reform, please state what reform(s) you support and explain the effect on the sustainability of our Social Security system.

America thanks you in advance for your candid response clearly outlining your position on Social Security. I will post your response on my blog.

Regards,

luridtransom

Wednesday, May 25, 2011

Sen. Jeff Wentworth voted FOR the Voter ID bill.

Dear Senator Wentworth,

Perhaps you read O. Ricardo Pimentel’s May 24th column on the Voter ID bill in the San Antonio Express-News. (Here’s a link to the column for your convenience: http://www.mysanantonio.com/default/article/Voter-ID-A-bogus-solution-for-a-pretend-crisis-1392650.php)

Mr. Pimentel contends there is “no credible evidence” of widespread voter fraud. He calls in-person voter fraud at the polls “Texas’s version of WMD.” In other words, voter fraud is a make-believe problem conjured up to justify the requirement to show a photo ID to vote. Making voters show a photo ID doesn't stop voter fraud, it just stops Democrats from voting. Because apparently lots of Democrats don't have photo IDs, but pretty much all Republicans do.

Is this true? Was the whole Voter ID bit just a clever scheme to keep the hordes of ID-less Democrats from voting? Or does Pimentel have it all wrong?

Let's settle this once and for all. Kindly point me to credible evidence of in-person voter fraud at the polls. Thank you.

Regards,

luridtransom

Readers: Please note a similar letter was sent to Gov. Perry. As you recall, Gov. Perry designated Voter ID one of the emergency items of this legislative session.

Perhaps you read O. Ricardo Pimentel’s May 24th column on the Voter ID bill in the San Antonio Express-News. (Here’s a link to the column for your convenience: http://www.mysanantonio.com/default/article/Voter-ID-A-bogus-solution-for-a-pretend-crisis-1392650.php)

Mr. Pimentel contends there is “no credible evidence” of widespread voter fraud. He calls in-person voter fraud at the polls “Texas’s version of WMD.” In other words, voter fraud is a make-believe problem conjured up to justify the requirement to show a photo ID to vote. Making voters show a photo ID doesn't stop voter fraud, it just stops Democrats from voting. Because apparently lots of Democrats don't have photo IDs, but pretty much all Republicans do.

Is this true? Was the whole Voter ID bit just a clever scheme to keep the hordes of ID-less Democrats from voting? Or does Pimentel have it all wrong?

Let's settle this once and for all. Kindly point me to credible evidence of in-person voter fraud at the polls. Thank you.

Regards,

luridtransom

Readers: Please note a similar letter was sent to Gov. Perry. As you recall, Gov. Perry designated Voter ID one of the emergency items of this legislative session.

Ligers are real?

BEIJING (AP) — A Chinese zoo official says two rare cubs born to a male lion and a female tiger are being nursed by a dog after they were abandoned by their mother.

Cong Wen of Xixiakou Wildlife Zoo in eastern China says four cubs called ligers were born to the lion and tiger earlier this month.

She said Tuesday the tiger mother fed the ligers for four days but then abandoned them for unknown reasons. Two died of weakness.

Cong said staff at the zoo in Shandong province found a dog who had just given birth to feed the surviving cubs.

She said the two cubs had trouble at first drinking milk from the dog but are now used to it.

Ligers are rare and are sometimes bred in zoos by mistake.

http://www.mysanantonio.com/news/article/Dog-nurses-2-ligers-after-tiger-mom-abandons-them-1392892.php#ixzz1NOJ75QSy

Tuesday, May 24, 2011

Dr. Vannoy Update.

Last time we checked in on Dr. Vannoy (4/21/2011), the ongoing mania was transforming a 1973 Sidney Vannoy 16' hull into an ass-kicking, ultralight, tiller steer poling skiff. This plan has been modified. The 1973 Sidney Vannoy 16' hull is now slated to become a tomato planter.

Dr. Vannoy’s New Skiff Plan is to build a modified Flats Stalker 18 (FS18) from scratch. (For more information on the FS18, check out Fruit Fly’s blog. He blogged all about building his FS18, the GB. He now uses his web presence to push novelty coolers. http://fruitfly-flatsstalker18build.blogspot.com/) Dr. Vannoy’s modifications are aimed at widening the bottom of the FS18. Long story short, Dr. Vannoy’s version of the FS18 will have a 46” transom instead of the standard 37” transom. This has the effect of making the skiff extra stable. Modified FS18 will have a manual jack plate. Trim tabs are unlikely.

The Vannoy trailer will be used for the modified FS18. It needs a new tire, a winch and a title (title?), but otherwise it’s in good shape and is a tailor-made skiff trailer. Ruben Lopez trailer is for sale, in case you know anybody who’s looking. The asking price is currently unknown, but we’ll post that as soon as we find out. So check back frequently for updates.

Three color schemes are under consideration. Each candidate scheme has 3 colors: two shades of the same color and a contrasting color. Dr. Vannoy is keeping the color concepts under wrap until a decision has been decided. Again, check back frequently for updates.

Letters from Lamar.

Dear luridtransom,

Thank you for contacting me about taxes and H.R. 1527, the Taxpayer Receipt Act. I appreciate hearing from you.

We agree that Americans are overtaxed. Lamar, you are LYING. I never said Americans are overtaxed. If you don't believe me, find the email I sent you and show me where it says Americans are overtaxed. You're a damn LIAR.

History tells us that tax reductions generate strong economic growth. They enable Americans to save, invest and spend more of their income. This creates a business environment that rewards creativity and innovation.

In the past, I have supported tax relief plans that benefit all taxpayers by reducing the marginal tax rate for all brackets, repealing the estate tax, increasing the child tax credit, and addressing the issue of the marriage tax penalty.

H.R. 1527 require [sic] the Secretary of the Treasury to provide each individual taxpayer a receipt for an income tax payment which itemizes the portion of the payment which is allocable to various Government spending categories. This bill has been referred to the House Ways and Means Committee, of which I am not a member. Be assured that as Congress considers legislation on this issue, I will continue to support reducing the tax burden on Americans.

Sincerely,

Lamar Smith

Member of Congress

Gentle Reader - For ease of reference, here's the question I posed to Congressman Smith regarding H.R. 1527: Are you FOR or AGAINST H.B. 1527?

I guess Lamar can't wrap his brain around my question because he's not on the House Ways and Means Committee. I hope you're proud, 21st District. I hope you're proud.

Thank you for contacting me about taxes and H.R. 1527, the Taxpayer Receipt Act. I appreciate hearing from you.

We agree that Americans are overtaxed. Lamar, you are LYING. I never said Americans are overtaxed. If you don't believe me, find the email I sent you and show me where it says Americans are overtaxed. You're a damn LIAR.

History tells us that tax reductions generate strong economic growth. They enable Americans to save, invest and spend more of their income. This creates a business environment that rewards creativity and innovation.

In the past, I have supported tax relief plans that benefit all taxpayers by reducing the marginal tax rate for all brackets, repealing the estate tax, increasing the child tax credit, and addressing the issue of the marriage tax penalty.

H.R. 1527 require [sic] the Secretary of the Treasury to provide each individual taxpayer a receipt for an income tax payment which itemizes the portion of the payment which is allocable to various Government spending categories. This bill has been referred to the House Ways and Means Committee, of which I am not a member. Be assured that as Congress considers legislation on this issue, I will continue to support reducing the tax burden on Americans.

Sincerely,

Lamar Smith

Member of Congress

Gentle Reader - For ease of reference, here's the question I posed to Congressman Smith regarding H.R. 1527: Are you FOR or AGAINST H.B. 1527?

I guess Lamar can't wrap his brain around my question because he's not on the House Ways and Means Committee. I hope you're proud, 21st District. I hope you're proud.

Attention Pulitzer Committee

Cats safe after North Side house fire

By Eva Ruth Moravec

A man and his four cats got out of a North Side home safely Tuesday morning, when a grease fire erupted in the kitchen, according to the San Antonio Fire Department.

Around 8:40 a.m., firefighters were called to a home in the 14000 block of Turtle Rock Street, where a small fire was reported, said Capt. Darryl Waltisperger. A man who lives in the home got out safely, but he feared that his four cats didn't, officials said. Firefighters said all of the felines were safe.

"All of those cats have either been accounted for or were seen running away from the house," Waltisperger said.

Flames caused an estimated $15,000 in damages to the single-story rock house. Waltisperger said grease fires are common but can be prevented.

"Don't leave things you're cooking unattended," he said. "Any little thing left unwatched can get out of control quickly."

http://www.mysanantonio.com/default/article/Cats-safe-after-North-Side-house-fire-1393264.php#ixzz1NHepL8fN

By Eva Ruth Moravec

A man and his four cats got out of a North Side home safely Tuesday morning, when a grease fire erupted in the kitchen, according to the San Antonio Fire Department.

Around 8:40 a.m., firefighters were called to a home in the 14000 block of Turtle Rock Street, where a small fire was reported, said Capt. Darryl Waltisperger. A man who lives in the home got out safely, but he feared that his four cats didn't, officials said. Firefighters said all of the felines were safe.

"All of those cats have either been accounted for or were seen running away from the house," Waltisperger said.

Flames caused an estimated $15,000 in damages to the single-story rock house. Waltisperger said grease fires are common but can be prevented.

"Don't leave things you're cooking unattended," he said. "Any little thing left unwatched can get out of control quickly."

http://www.mysanantonio.com/default/article/Cats-safe-after-North-Side-house-fire-1393264.php#ixzz1NHepL8fN

Thursday, May 19, 2011

Remember the Alamodome.

SA City Council decides today whether to change the name of Durango Blvd to César Chávez Blvd. The proposed name change would cost the City $100,000.

UPDATE:

The City Council voted 7-4 on Thursday to rename Durango Boulevard in honor of civil rights activist and labor leader César Chávez.

Supporters appeared to outnumber opponents in council chambers and spoke passionately about Chávez and his contributions to their lives. Those against the proposal cited the $100,000 price tag for changing street signs and the burden that will be placed on property owners whose addresses will change.

http://www.mysanantonio.com/default/article/Durango-Boulevard-renamed-for-Cesar-Ch-vez-on-1386997.php#ixzz1MpZ1x3YR

Wednesday, May 18, 2011

Bauhaus School

You know that red mulch that looks like it's been soaked in red food coloring? If I had an NPR microphone I'd righteously call it NASCAR mulch.

I'm looking at you, NPR.

The next j-school grad with a microphone I hear use the term "tax loophole" for tax deduction or tax credit has an official inquiry email from luridtransom headed his way.

Tuesday, May 17, 2011

Gaining Momentum.

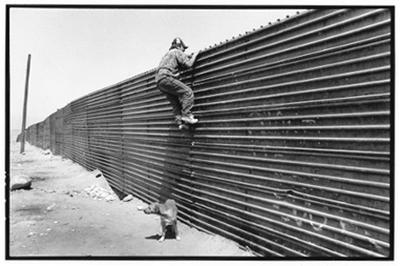

I'll level with you, Americans, Mexicans and illegal immigrants. I have low expectations for Lamar Smith's explanation of A+ border security.

How about this: Mr. Smith, if you prove me wrong, and you provide a thorough, substantive reponse addressing my questions on border security, I'LL VOTE FOR YOU NEXT YEAR.

How about this: Mr. Smith, if you prove me wrong, and you provide a thorough, substantive reponse addressing my questions on border security, I'LL VOTE FOR YOU NEXT YEAR.

America believes in second chances.

Dear Congressman Smith:

Thank you for your response. However, I noticed you did not even attempt to respond to my question. In fact, I’m left to wonder if you even read my original e-mail. Let me recap. Ezra Klein’s “insightful article,” which you reference in your response, discusses a proposal that to be eligible for Medicare, you would have to give someone power-of-attorney and sign a living will. You could tell your attorney-in-fact, and write in your living will, that you want every possible measure employed to keep you alive. You could say cost is no object, and neither is pain or quality of life. Or, you could instruct your attorney-in-fact not to prolong your life by extraordinary measures if you lost consciousness in a long, fatal illness or simply old age. You could make whatever choice, and offer whatever instructions, you want. You just have to do it. You have to make the decision.

So, I’ll ask again: Are you FOR or AGAINST a mandatory power-of-attorney and living will to be eligible for Medicare benefits? State whether you are FOR or AGAINST this idea, and then you can explain your position all you want. I know you will support only those changes to Medicare that do not penalize our nation's seniors. I want to know if you support THIS proposed change to Medicare.

Thank you in advance, Congressman, for your straight-forward response on your second attempt. Which I will post on my blog.

Regards,

luridtransom

Thank you for your response. However, I noticed you did not even attempt to respond to my question. In fact, I’m left to wonder if you even read my original e-mail. Let me recap. Ezra Klein’s “insightful article,” which you reference in your response, discusses a proposal that to be eligible for Medicare, you would have to give someone power-of-attorney and sign a living will. You could tell your attorney-in-fact, and write in your living will, that you want every possible measure employed to keep you alive. You could say cost is no object, and neither is pain or quality of life. Or, you could instruct your attorney-in-fact not to prolong your life by extraordinary measures if you lost consciousness in a long, fatal illness or simply old age. You could make whatever choice, and offer whatever instructions, you want. You just have to do it. You have to make the decision.

So, I’ll ask again: Are you FOR or AGAINST a mandatory power-of-attorney and living will to be eligible for Medicare benefits? State whether you are FOR or AGAINST this idea, and then you can explain your position all you want. I know you will support only those changes to Medicare that do not penalize our nation's seniors. I want to know if you support THIS proposed change to Medicare.

Thank you in advance, Congressman, for your straight-forward response on your second attempt. Which I will post on my blog.

Regards,

luridtransom

You will have my views in mind? What views? I didn't tell you my views. I asked you a FOR/AGAINST question you didn't answer. Can you even read?

Dear luridtransom,

Many thanks for your thoughtfulness in forwarding a copy of Ezra Klein's insightful article. I appreciate having the benefit of this information.

We agree that all seniors should receive adequate and affordable health care. Over its thirty-two year history, Medicare has provided important services to millions of Americans. However, due to the rising cost of health care and the increasing number of individuals over the age of 65, Medicare will soon become insolvent if the program is not reformed.

Congress has increased, in the short term, the life expectancy of the Medicare trust fund. But Medicare still faces many challenges due to unexpected increases in medical cost. I will support only those changes that do not penalize our nation's seniors.

It is always helpful to receive input from friends and constituents. Be assured that I will have your views in mind when legislation concerning these matters are considered in the House.

For more information on my work in Congress or to send me an electronic message, please visit the 21st District's website, http://lamarsmith.house.gov.

Sincerely,

Lamar Smith

Member of Congress

Many thanks for your thoughtfulness in forwarding a copy of Ezra Klein's insightful article. I appreciate having the benefit of this information.

We agree that all seniors should receive adequate and affordable health care. Over its thirty-two year history, Medicare has provided important services to millions of Americans. However, due to the rising cost of health care and the increasing number of individuals over the age of 65, Medicare will soon become insolvent if the program is not reformed.

Congress has increased, in the short term, the life expectancy of the Medicare trust fund. But Medicare still faces many challenges due to unexpected increases in medical cost. I will support only those changes that do not penalize our nation's seniors.

It is always helpful to receive input from friends and constituents. Be assured that I will have your views in mind when legislation concerning these matters are considered in the House.

For more information on my work in Congress or to send me an electronic message, please visit the 21st District's website, http://lamarsmith.house.gov.

Sincerely,

Lamar Smith

Member of Congress

So, in conclusion, what was the question?

Dear Senator Hutchison,

I appreciate your prompt and information-packed response to my inquiry regarding the mortgage income deduction. I am glad you are well-versed on the mortgage interest deduction, the federal deficit and debt, and the proposals to scale back the mortgage interest deduction. However, it appears you completely avoided my question.

In my inquiry, I asked you to state whether you are FOR or AGAINST the mortgage interest deduction status quo. After reading your response, I have no idea what your position is.

Americans deserve to know your position on the mortgage interest deduction. So once again, please state whether you are FOR or AGAINST the mortgage interest deduction status quo. You can explain your position all you want. If you refuse to take a position, please expressly state that you refuse to take a position.

Thank you in advance for clearly stating your position on the mortgage interest deduction. I will post your response on my blog.

Regards,

luridtransom

Senator Hutchison's Response to my Mortgage Interest Deduction Query.

Dear Friend:

Thank you for contacting me regarding the home mortgage loan interest deduction. I welcome your thoughts and comments.

Since 1913, households have been able to deduct the interest paid on home mortgage loans on their income tax returns. Homeownership is an essential part of the American Dream, and the mortgage interest deduction is very important to many Americans on the path to homeownership.

However, out-of-control spending has put the United States in a tenuous economic position. Over the past two years, the federal government has posted deficits of $1.4 trillion and $1.3 trillion, respectively. This increase in spending has put our nation’s debt on an upward trajectory. Our nation’s debt surpassed a historical $14 trillion benchmark in December 2010, and it continues to grow by more than $4 billion per day, on average.

With this long-term budget crisis looming, it is imperative that we address our nation’s fiscal situation in the near future and that we achieve fiscal sustainability over the long run. A number of ideas have been been proposed to address our nation's dire fiscal situation, and some have included scaling back the mortgage interest deduction.

One idea was submitted by President Barack Obama in his fiscal year (FY) 2011 budget proposal. Under the President's budget, Americans paying taxes in the two highest tax brackets would be limited to deducting their home mortgage interest at the 28% rate.

Another idea was suggested by the National Commission on Fiscal Responsibility and Reform in its final report of recommendations aimed at addressing our nation's fiscal challenges. The fiscal commission's proposal would reform the tax code, lowering all tax rates but also removing a number of key deductions such as the mortgage interest deduction. In its place, households would be able to claim a non-refundable tax credit accounting for charitable giving and mortgage interest.

I believe that Congress must continue to strive to improve access to affordable housing, support community development, and increase homeownership, while not imposing an undue tax burden on Americans. However, we also need to get our nation’s financial house in order and have fiscal sustainability going forward.

I will continue to review recommendations aimed at addressing our nation's mounting debt, and, in particular, study the ramifications that such proposals will have on all Americans. You may be certain that I will continue to work toward spending cuts. I will also keep pushing for smaller government, a balanced federal budget, and lower taxes on families and small businesses.

I appreciate hearing from you. I hope that you will not hesitate to contact me on any issue that is important to you.

Sincerely,

Kay Bailey Hutchison

United States Senator

284 Russell Senate Office Building

Washington, DC 20510

202-224-5922 (tel)

202-224-0776 (fax)

http://hutchison.senate.gov

Thank you for contacting me regarding the home mortgage loan interest deduction. I welcome your thoughts and comments.

Since 1913, households have been able to deduct the interest paid on home mortgage loans on their income tax returns. Homeownership is an essential part of the American Dream, and the mortgage interest deduction is very important to many Americans on the path to homeownership.

However, out-of-control spending has put the United States in a tenuous economic position. Over the past two years, the federal government has posted deficits of $1.4 trillion and $1.3 trillion, respectively. This increase in spending has put our nation’s debt on an upward trajectory. Our nation’s debt surpassed a historical $14 trillion benchmark in December 2010, and it continues to grow by more than $4 billion per day, on average.

With this long-term budget crisis looming, it is imperative that we address our nation’s fiscal situation in the near future and that we achieve fiscal sustainability over the long run. A number of ideas have been been proposed to address our nation's dire fiscal situation, and some have included scaling back the mortgage interest deduction.

One idea was submitted by President Barack Obama in his fiscal year (FY) 2011 budget proposal. Under the President's budget, Americans paying taxes in the two highest tax brackets would be limited to deducting their home mortgage interest at the 28% rate.

Another idea was suggested by the National Commission on Fiscal Responsibility and Reform in its final report of recommendations aimed at addressing our nation's fiscal challenges. The fiscal commission's proposal would reform the tax code, lowering all tax rates but also removing a number of key deductions such as the mortgage interest deduction. In its place, households would be able to claim a non-refundable tax credit accounting for charitable giving and mortgage interest.

I believe that Congress must continue to strive to improve access to affordable housing, support community development, and increase homeownership, while not imposing an undue tax burden on Americans. However, we also need to get our nation’s financial house in order and have fiscal sustainability going forward.

I will continue to review recommendations aimed at addressing our nation's mounting debt, and, in particular, study the ramifications that such proposals will have on all Americans. You may be certain that I will continue to work toward spending cuts. I will also keep pushing for smaller government, a balanced federal budget, and lower taxes on families and small businesses.

I appreciate hearing from you. I hope that you will not hesitate to contact me on any issue that is important to you.

Sincerely,

Kay Bailey Hutchison

United States Senator

284 Russell Senate Office Building

Washington, DC 20510

202-224-5922 (tel)

202-224-0776 (fax)

http://hutchison.senate.gov

Monday, May 16, 2011

The mortgage interest deduction. Are Texas's senators FOR or AGAINST status quo? (Responses will be posted upon receipt.)

Dear Senator:

Currently the Internal Revenue Code allows deduction of mortgage interest on mortgages of up to $1 million. You can deduct mortgage interest for a first and second home. This is an over-simplification, of course – see http://www.irs.gov/publications/p936/ar02.html or consult your tax adviser for a more thorough explanation.

The nonpartisan Joint Committee on Taxation says the mortgage interest deduction will decrease tax revenues for FY 2011 by $93.8 billion. (Source: http://articles.latimes.com/2011/jan/23/business/la-fi-harney-20110123) To put this in context, the CBO projects total revenues of $2.228 trillion and total outlays of $3.708 trillion for a deficit of $1.48 trillion for 2011. (And really, if there’s no context, it’s meaningless, right?) So this means if you eliminated the mortgage interest deduction and kept outlays constant, the deficit would be $1.39 trillion for 2011. That’s a 6.1% deficit reduction.

Harvard economics professor Edward Glaeser has some interesting thoughts on the mortgage interest deduction. Most notably, Glaeser concludes that “the home mortgage interest deduction is poorly designed to encourage homeownership, which is, after all, the alleged desideratum.” I’m sure you’ll find Prof. Glaeser’s article of interest: http://economix.blogs.nytimes.com/2009/02/24/killing-or-maiming-a-sacred-cow-home-mortgage-deductions/

Please tell me whether you are FOR or AGAINST keeping the mortgage interest deduction status quo. If you are FOR the status quo, please explain why. Also, if you are FOR the status quo, perhaps you disagree with Prof. Glaeser’s conclusions. In that case, please feel free to explain your disagreements. If you are AGAINST the status quo, please tell America what changes you’d like to see made. Thank you in advance for your response, which I will post on my blog.

Regards,

luridtransom

Currently the Internal Revenue Code allows deduction of mortgage interest on mortgages of up to $1 million. You can deduct mortgage interest for a first and second home. This is an over-simplification, of course – see http://www.irs.gov/publications/p936/ar02.html or consult your tax adviser for a more thorough explanation.

The nonpartisan Joint Committee on Taxation says the mortgage interest deduction will decrease tax revenues for FY 2011 by $93.8 billion. (Source: http://articles.latimes.com/2011/jan/23/business/la-fi-harney-20110123) To put this in context, the CBO projects total revenues of $2.228 trillion and total outlays of $3.708 trillion for a deficit of $1.48 trillion for 2011. (And really, if there’s no context, it’s meaningless, right?) So this means if you eliminated the mortgage interest deduction and kept outlays constant, the deficit would be $1.39 trillion for 2011. That’s a 6.1% deficit reduction.

Harvard economics professor Edward Glaeser has some interesting thoughts on the mortgage interest deduction. Most notably, Glaeser concludes that “the home mortgage interest deduction is poorly designed to encourage homeownership, which is, after all, the alleged desideratum.” I’m sure you’ll find Prof. Glaeser’s article of interest: http://economix.blogs.nytimes.com/2009/02/24/killing-or-maiming-a-sacred-cow-home-mortgage-deductions/

Please tell me whether you are FOR or AGAINST keeping the mortgage interest deduction status quo. If you are FOR the status quo, please explain why. Also, if you are FOR the status quo, perhaps you disagree with Prof. Glaeser’s conclusions. In that case, please feel free to explain your disagreements. If you are AGAINST the status quo, please tell America what changes you’d like to see made. Thank you in advance for your response, which I will post on my blog.

Regards,

luridtransom

Response from Gov. Perry. He refuses to answer questions about his Frisbee golf game.

May 16, 2011

Dear luridtransom:

Thank you for writing to the Office of the Governor.

Our office does not distribute grant funding. However, the Texas Parks and Wildlife Department (TPWD) oversees several grant programs for communities seeking to improve their parkland. Eligible projects include ball fields, playgrounds, trails, camping facilities, beautification, restoration and more.

Please note that TPWD is an independent state agency, and the governor has no role in its day-to-day operations, including determining grant awards. You may wish to contact TPWD to share your concerns. You can do so by calling, toll-free, (800) 792-1112.

We understand that Helotes city officials decided not to apply for a beautification grant. We encourage you to keep in contact with your city council members if issues such as this arise in the future.

Please write to our office whenever we can be of assistance.

Sincerely,

/s/

Dede Keith

Constituent Communication Division

Office of the Governor

DK:sdp

Friday, May 13, 2011

Health care stats, USA Today style.

Wednesday, May 11, 2011

Letters to Lamar.

Dear Congressman Smith:

In response to President Obama’s speech on immigration reform, you released a statement including the following:

“The non-partisan Government Accountability Office has found that only 44% of the border is under the operational control of the Border Patrol, and only 15% is under actual control. Mr. President, 44% is a failing grade. And if 44% is the most secure the border has ever been, it’s time to get to work to improve the grade. The American people expect nothing less than an A+ on border security.”

https://lamarsmith.house.gov/News/DocumentSingle.aspx?DocumentID=240574

Please explain what the percentages you cited actually mean, and explain your plan for achieving an “A+” on border security. Also, please tell me the benefits of your A+ Plan versus the status quo. Finally, please tell me how much your A+ Plan costs, and compare that cost to the current cost of border security. List these costs in actual dollar amounts. Thank you for your straight-forward and thorough answers, which I will post on my blog.

Regards,

Matt Bishop

Monday, May 09, 2011

Texas Tech: You fired Mike Leach and hired a birther. I hope you're happy.

From the Lubbock Avalanche-Journal:

Texas Tech coach Tommy Tuberville appeared on conservative commentator Sean Hannity’s television show Tuesday [4/26], taking part in a panel discussion about President Obama’s Easter Sunday pastor, the controversy over his birth location and who might run against him in 2012.

Tuberville suggested that the president has a good chance to be unseated by whoever opposes him.

Asked by Hannity if there is anyone he likes for president, Tuberville said, “It really doesn’t make any difference. If the economy doesn’t get better, if the price of gas is six or seven dollars a gallon, if we’re still in wars, anybody’s going to run and win. Bottom line, we can’t keep going the direction we’re going.”

Tuberville was the day’s celebrity guest on “The Great American Panel” segment, joining in with former Maryland Gov. Robert Ehrlich and FOX News legal analyst Tamara Holder in a discussion moderated by Hannity.

The first family’s attendance at an Easter service led by the Rev. Wallace Charles Smith was the first topic. Smith, who has compared conservative commentator Rush Limbaugh to the Ku Klux Klan, has been accused by the right of race baiting.

“We’ve got to have leadership in this country,” Tuberville said. “For our president to do something like this, to go to a church and portray an image like this, doesn’t represent all people. I’m a football coach, and I have to represent everybody on our football team and our alumni and our fan base. I’m the leader, and you have to do that, so leadership’s very important.”

***

Tuberville later called on the president to produce his birth certificate. Last month, potential presidential candidate Donald Trump made headlines by questioning Obama’s birth and citizenship.

Hannity acknowledged the existence of a certification of live birth and birth announcements shortly after Obama was born, but showed statistics saying many Americans are unconvinced.

“We’ve got enough controversy going on in this country,” Tuberville said. “I don’t know why he wouldn’t just step up and say, ‘Here it is.’ Obviously, there’s got to be something on there he doesn’t want anybody to see.”

http://www.redraiders.com/2011/04/26/tuberville-weighs-in-on-conservative-talk-show/

Wednesday, May 04, 2011

And that mule went on to save Spring Break.

Luridtransom asked AARP, via e-mail, to state whether it is FOR or AGAINST requiring a power-of-attorney and living will to be eligible for Medicare.

For some reason I'm on Barry Jackson's AARP e-mail list. Here's his latest. (No clue why it's addressed to George.)

Dear George,

We need 75,000 activists to stand up for Medicare and Social Security.

Tell Congress: Don't harm Medicare and Social Security.

The message is simple: Don't harm Medicare or Social Security. Right now, Congress is considering making a deal to pay the nation's bills (or in Washington-speak, raise the debt ceiling) that could include reduced Medicare benefits and millions left without secure healthcare.

Congress needs to understand that Medicare protects real people. It is not simply numbers on a balance sheet – and they need to hear that people like you are against drastic cuts to Medicare and Social Security.

We need 75,000 activists to send a strong message to Congress by May 13th. Will you join me and speak up today? Tell Congress to stop harmful cuts to Medicare and Social Security.

Congress should not address the federal deficit by breaking the promise of secure healthcare that seniors have earned through years of hard work. But right now Congress is considering budget deals that could:

Re-open the Medicare "doughnut hole" and raise seniors' drug costs.

Eliminate Medicare as we know it for future retirees by turning Medicare into a voucher-like system that would double healthcare costs for seniors.

Place arbitrary limits on Medicare spending that could increase your costs and limit your access to care.

George, there's a lot at stake in the weeks to come. Congress must understand that Medicare is more than just a line in the budget – it provides health security that millions of Americans depend on each year.

Don't let Congress put the health of older Americans at risk. Now is the time to make sure your member of Congress knows where you stand in this fight.

Click here to tell your members of Congress to protect Medicare and Social Security from harmful cuts.

Thank you for standing with us to protect Medicare and Social Security.

Sincerely,

Barry Jackson

Senior Manager, Grassroots

We need 75,000 activists to stand up for Medicare and Social Security.

Tell Congress: Don't harm Medicare and Social Security.

The message is simple: Don't harm Medicare or Social Security. Right now, Congress is considering making a deal to pay the nation's bills (or in Washington-speak, raise the debt ceiling) that could include reduced Medicare benefits and millions left without secure healthcare.

Congress needs to understand that Medicare protects real people. It is not simply numbers on a balance sheet – and they need to hear that people like you are against drastic cuts to Medicare and Social Security.

We need 75,000 activists to send a strong message to Congress by May 13th. Will you join me and speak up today? Tell Congress to stop harmful cuts to Medicare and Social Security.

Congress should not address the federal deficit by breaking the promise of secure healthcare that seniors have earned through years of hard work. But right now Congress is considering budget deals that could:

Re-open the Medicare "doughnut hole" and raise seniors' drug costs.

Eliminate Medicare as we know it for future retirees by turning Medicare into a voucher-like system that would double healthcare costs for seniors.

Place arbitrary limits on Medicare spending that could increase your costs and limit your access to care.

George, there's a lot at stake in the weeks to come. Congress must understand that Medicare is more than just a line in the budget – it provides health security that millions of Americans depend on each year.

Don't let Congress put the health of older Americans at risk. Now is the time to make sure your member of Congress knows where you stand in this fight.

Click here to tell your members of Congress to protect Medicare and Social Security from harmful cuts.

Thank you for standing with us to protect Medicare and Social Security.

Sincerely,

Barry Jackson

Senior Manager, Grassroots

Monday, May 02, 2011

Dear Congressman Smith,

Re. H.R. 1527

Legislation was recently introduced in the House to provide each American with an itemized tax receipt. Here’s more about that: http://cooper.house.gov/index.php?option=com_content&task=view&id=479&Itemid=73

The bill would provide a written receipt for those filing paper tax returns and an electronic receipt for those that e-file. The receipt would include a breakdown of each individual’s contributions to Social Security, defense spending, Medicare, and other federal programs, as well as the total amount of federal debt and how much the federal government has borrowed per citizen.

Are you FOR or AGAINST H.B. 1527?

Regards,

Matt Bishop

Re. H.R. 1527

Legislation was recently introduced in the House to provide each American with an itemized tax receipt. Here’s more about that: http://cooper.house.gov/index.php?option=com_content&task=view&id=479&Itemid=73

The bill would provide a written receipt for those filing paper tax returns and an electronic receipt for those that e-file. The receipt would include a breakdown of each individual’s contributions to Social Security, defense spending, Medicare, and other federal programs, as well as the total amount of federal debt and how much the federal government has borrowed per citizen.

Are you FOR or AGAINST H.B. 1527?

Regards,

Matt Bishop

Subscribe to:

Posts (Atom)